clinto

Moderator, wonderful human being & practicing Deuc

Staff member

Administrator

Super Moderator

Steel Soldiers Supporter

Supporting Vendor

- 12,609

- 1,164

- 113

- Location

- Athens, Ga.

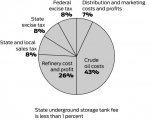

Two charts and articles, one from Michigan and one from California. I assume there could be small differences state to state.As I understand it, about 50% of the cost of a gallon of gas is the actual tax on it, which does not go to fund the infrastructure we drive on. I could be wrong, but that's what was being touted when diesel went over $4.00 a gallon last year.

AG - Gas Prices

A close look at gasoline prices - SFGate

Attachments

-

28.3 KB Views: 181

-

44 KB Views: 174